March 10, 2020

A growing number of states and cities are considering legislation to expand their False Claims Acts to cover tax fraud. The expanded laws will enlist whistleblowers in the fight to uncover major tax cheats, recover unpaid taxes, and close the tax gap.

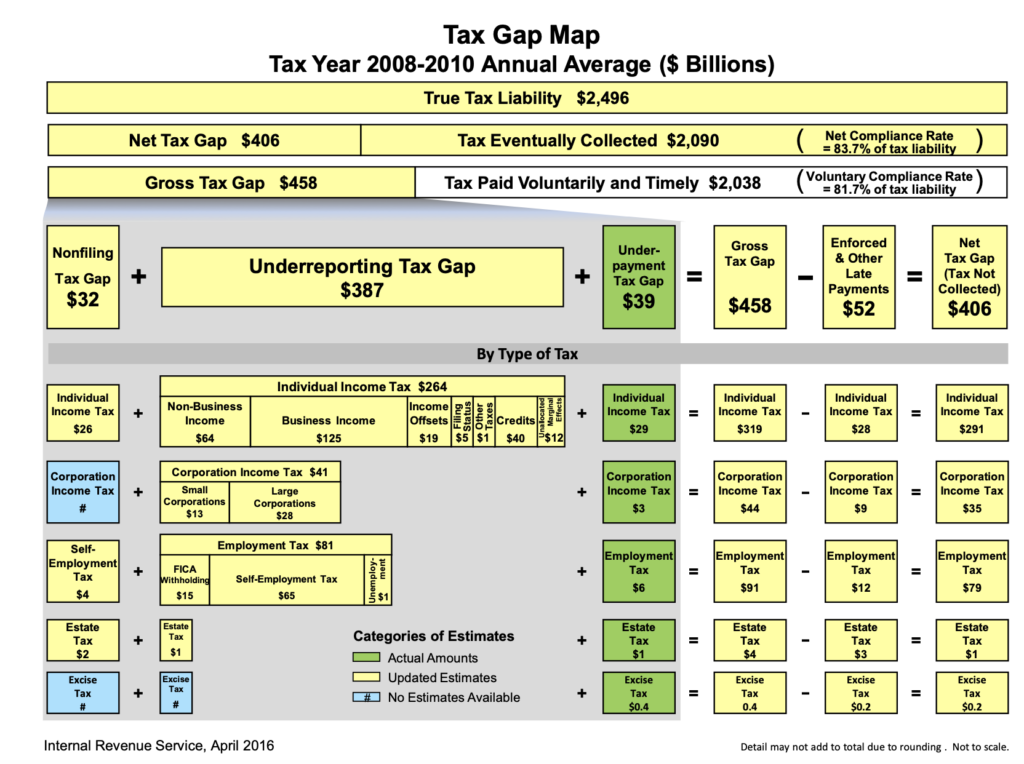

In simple terms, the tax gap is the difference between all the taxes that are owed and those paid. It is also a way to measure who isn’t paying their fair share of taxes. And it puts a price tag on how much that is costing the rest of us. As it turns out, it costs quite a lot.

The last time it looked, the IRS estimated that the federal tax gap was at least $458 billion each year.

That was more than five years ago. It isn’t just the federal government that loses out. For example, the California Legislative Analyst’s Office estimated that the California tax gap was $6.5 billion each year. And that was almost fifteen years ago.

California is not the only state being shortchanged by businesses and individuals who fail to report their true income and pay their taxes. Tax cheats plague cities and counties as well by lying about sales, underreporting income, and hiding assets. What can we do?

States, counties, and cities have tried different solutions to expand tax compliance and increase tax revenues. One obvious solution is to expand the agencies responsible for identifying nonpayers, auditing tax returns, and collecting taxes. But those proposals are not always politically popular. And they require increased spending. That puts additional pressure on already underfunded government budgets.

Other states have tried the power of public shaming. By law, California’s tax agency is required to publish a list of the 500 largest tax delinquencies twice a year. Such initiatives may shine a light on past tax losses. But they do very little to uncover and deter ongoing tax fraud.

A growing number of state and local governments are looking at New York’s success in using its False Claims Act to combat tax fraud. The New York program encourages people with inside information on significant tax cheating to use the False Claims Act to report that fraud to the New York Taxpayer Protection Bureau. Those caught cheating on their taxes must pay up to three times the amount they failed to pay. If the New York tax authority, or the whistleblower acting on its behalf, recovers money from a defendant, the whistleblower receives a percentage of that recovery.

Since it was passed in 2010, the expanded New York False Claims Act has resulted in $467 million in recoveries for the State of New York. These recoveries are thanks to tax fraud tips from whistleblowers. In one case, New York recovered $330 million from Sprint Corporation for unpaid sales taxes. The whistleblower in that case received an award of more than $62 million.

The New York Law seeks to ensure that its program targets only big-ticket and serious tax fraud. Thus, it applies only to cases involving sales or income of more than $1 million in a single year. And the whistleblower must show a tax loss of more than $350,000.

In September 2019 we reported on a bill in the California Assembly to expand that state’s False Claims Act to include tax fraud. Earlier this month, a California Assemblyman re-introduced legislation to rewrite the California False Claims Act to include tax fraud, along the lines of the expanded New York law. Under the proposed California law, whistleblowers must identify tax fraud committed by a business or person with net sales or income of more than $500,000 and show a tax loss of at least $200,000.

Both Michigan and the District of Columbia are also considering expanding their False Claims Acts to include tax fraud. Both proposals use the New York levels of $1 million in net income or sales tax and $350,000 in losses. The bill under consideration in the Michigan House also includes a provision that limits the ability of private party whistleblowers to obtain tax records or information in False Claims Act litigation. Under the proposed Michigan law, the Michigan Attorney General’s Office must approve any requests for tax returns or tax information before release of those materials.

The limits on access to tax returns and tax information, and the significant dollar thresholds, are practical, common-sense safeguards to ensure that the False Claims Act could not be misused by private whistleblowers and would only impact large dollar tax cheats.

As New York’s results show, enlisting whistleblowers with insider knowledge to combat tax fraud is a classic ‘win win’ proposal. The government comes out ahead and collects hundreds of millions of otherwise unpaid taxes. The whistleblowers receive an award for identifying businesses and individuals who are committing tax fraud. The only losers are the tax cheats themselves, who finally have to pay their fair share of taxes. Just like the rest of us.

If you are considering submitting a matter that involves tax fraud to the IRS or to a State Agency we urge to contact us for a free, confidential, consultation. We can explain the IRS whistleblower process in detail. We can also review the options of filing a False Claims Action in New York or states with similar laws.