February 12, 2024

Many insurance companies require patients to make a copay when the insurance pays for certain medical bills. Co-pays can be burdensome for patients. But the government views them as an important part of Medicare. As a result, routine copay waiver is illegal and results in criminal and civil penalties. Routine co-payment waiver also violates the False Claims Act, and the government and whistleblowers can recover millions of dollars for this practice.

Copay is short for copayment. It is a portion of a medical bill that the patient is responsible for paying directly to the provider. The amount of a co-pay is set by the insurer. For example, the copay under Medicare Part B, which covers doctor visits and most out of hospital services, is 20% of the total approved charge.

Copays are not charged for all procedures. For example, the Affordable Care Act, also known as Obamacare, requires that certain preventative procedures must be covered without any cost sharing.

Copayments, coinsurance and deductibles are collectively referred to as patient cost sharing. The Government views them as an integral part of the Medicare and Medicaid programs. It believes that requiring patients to share some costs makes them better health care consumers. This is a hotly debated issue in health policy. Recent proposals to reform health care, including most Medicare for All proposals, entirely eliminate patient cost sharing.

Copay waiver occurs whenever a health care provider or supplier is paid by an insurer but chooses not to collect a copay. Co-pay waiver can take several forms. These include:

It is important to remember that not all copay waivers are illegal. Only routine co-pay waivers designed to induce additional business that violate the law. For example:

Routine Copay Waiver Violates The Law

Routine Copay Waiver Violates The LawIt is not illegal to write off a patient’s copay balance if the provider makes a good-faith attempt to collect. However, when a provider has a policy of not attempting to collect copays that becomes illegal. Health and Human Services, Office of Inspector General, identified several suspect behaviors that indicate illegal routine copay waiver.

It is entirely appropriate for providers, practitioners or suppliers to forgive the copayment if the patient has a demonstrable financial hardship. Similarly, a legitimate Patient Assistance Program (often referred to as PAP) is entirely legal. However, the provider must make an individualized determination of patient need. When a provider regularly waives copays due to financial hardship without actually evaluating patients’ needs, it violates the law.

The government has recently been cracking down on a sophisticated version of this fraud. Large companies help establish independent Patient Assistance Programs. Those charities, in turn, pay co-payments for customers of the company’s product. The government recognizes this as illegal copay waivers and, along with whistleblowers, has obtained millions of dollars in settlements. These include:

Pharmaceutical manufacturers offer copayment coupons to insured patients to reduce or eliminate patients’ out-of-pocket costs for their branded drugs. Sometimes, manufacturers may contract with coupon vendors to create and administer coupon programs on their behalf. A manufacturer may offer a coupon for a branded drug to reduce the copay below its competitors. Sometimes, the coupon eliminates the copayment altogether.

Copay coupons are legal for patients covered by private insurance, but illegal for Medicare Part D recipients. Nevertheless, in 2014, HHS-OIG found that 6%-7% of Medicare recipients reported using copay coupons. When sponsors of these programs do not take sufficient care to exclude Medicare recipients, they can violate the law.

Routine waiver of deductibles and co-pays violates the law for two reasons. First, it violates the Anti-Kickback Statute. Second, it causes Medicare to pay more than it should in violation of the False Claims Act.

The Anti-Kickback Statute prohibits medical providers from offering, soliciting, paying, or receiving anything of value in exchange for referrals of Government Health patients. Discounts are a form of kickback under the Anti-Kickback Statute. Therefore, when a provider regularly waives copays in order to make his services seem cheaper to potential customers, he is offering a thing of value and violates the Anti-Kickback Statute.

Moreover, providers and manufacturers often use copay waivers to induce doctors to prescribe their drugs or products instead of cheaper generic competitors. The Anti-Kickback Statute also prohibits offering discounts to induce prescriptions or referrals of your product.

The False Claims Act forbids anyone from submitting a false or fraudulent claim to the government. Routine waiver of copays leads to false claims for two reasons.

First, the Government does not pay for claims induced by illegal kickbacks. Thus, claims induced by violation of the Anti-Kickback Statute are false under the False Claims Act.

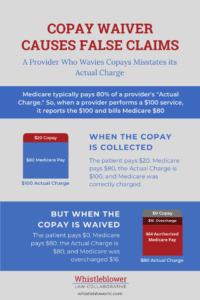

Second, a provider that routinely waives copays or deductibles is lying to the government about the cost of the drug. Medicare typically pays 80 percent of the reasonable charge for a good or service. Generally, Medicare will not pay more than the customary charge or the highest prevailing charge.

So, when a provider tells the government that the “actual charge” is $100, Medicare is willing to pay $80. But, when the provider routinely waives the $20 copayment, the actual charge is $80. The provider inflated his actual cost by $20, and if Medicare had known the truth, it would only have paid 80% of that or $64.

Under the False Claims Act, a provider is liable for three times the damages plus False Claims Act penalties. In 2024, False Claims Act penalties range as high as $27,894 per false claim. Under the Anti-Kickback Statute, a provider can be liable for up to 5 years imprisonment and $25,000 per violation. In addition, OIG may also initiate administrative proceedings to exclude a person from Federal health care programs.

While it seems like waiving copays is good for patients, the Government takes a different view. Routinely waiving copays can violate the Anti-Kickback Statute and the False Claims Act. These violations can lead to lawsuits worth millions of dollars to the government and whistleblowers. If you are aware of a provider that routinely waives copays, Whistleblower Law Collaborative can help.