Today, the Department of Justice and the United States Attorney for the District of Massachusetts announced that athenahealth Inc. (Athena) has settled two False Claims Act qui tam cases for $18.25 million. The settlement resolves allegations that Athena paid illegal kickbacks to generate sales of its electronic health record (EHR) product, athenaClinicals.

In announcing the settlement, United States Attorney Andrew E. Lelling said:

“Across the country, physicians rely on electronic health records software to provide vital patient data. Kickbacks corrupt the market for health care services and risk jeopardizing patient safety. We will aggressively pursue organizations that fail to play by the rules; EHR companies are no exception.”

We are co-counsel to the relators in one of those qui tam cases.

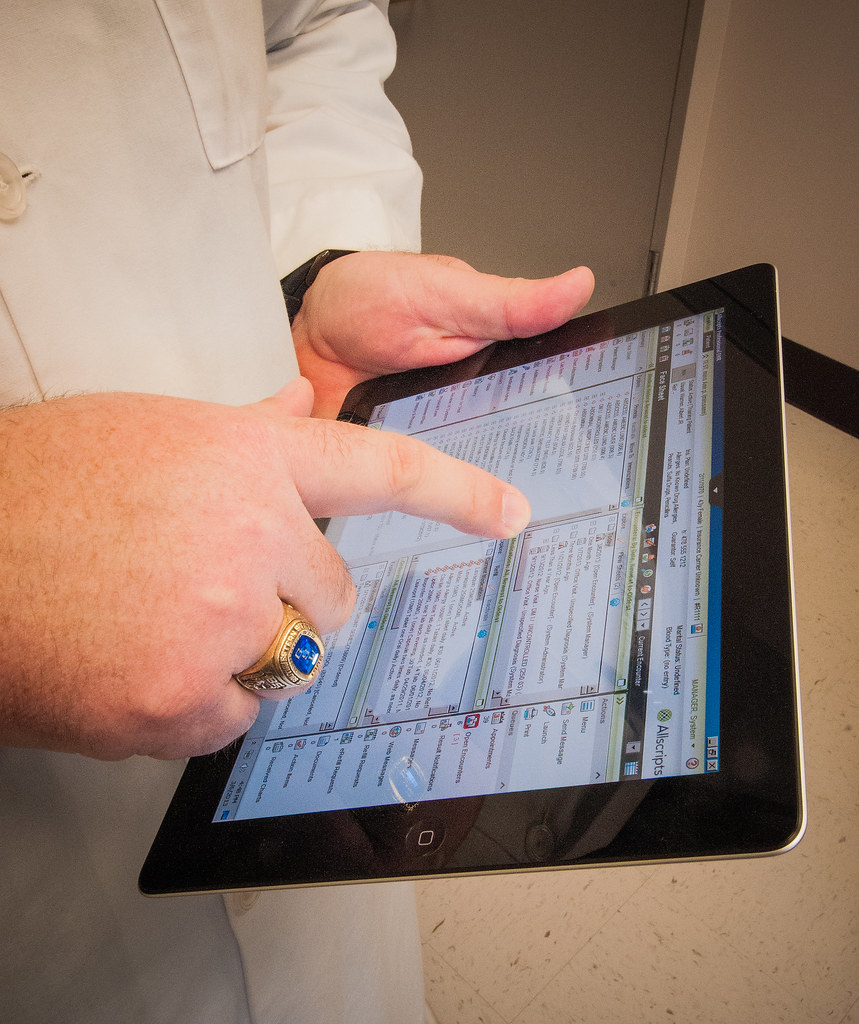

Athena Offers EHR Technology to Healthcare Providers Nationwide

Athena is a medical software company based in Watertown, Massachusetts. It offers cloud-based electronic health record technology and services to health care providers nationwide. Athena’s EHR platform, athenaClinicals, can be purchased as a standalone service or as part of a suite of EHR, billing, and patient engagement products known as athenaOne. Athena serves more than 160,000 healthcare providers across the United States.

The United States and the relators contend that Athena offered and provided illegal remuneration to generate sales of athenaClinicals, either on its own or as part of athenaOne. In doing so, Athena violated the Anti-Kickback Statute. Those violations in turn rendered claims submitted by providers to federal health care programs false or fraudulent under the False Claims Act.

Athena’s Kickbacks Included Lavish Trips

The Government’s complaint in intervention describes three kickback programs. Athena has now ceased all of them.

First, Athena provided hundreds of existing and potential clients with all-expense paid trips to sporting, entertainment, and recreational events. These “Concierge Events” included the Masters golf tournament, the Kentucky Derby, NFL, NBA, and MLB games, the NCAA “Final Four,” the Indy 500, and New York Fashion Week.

Joseph R. Bonavolonta, Special Agent in Charge of the FBI’s Boston Division, stated:

“It is illegal for companies to extend invitations to all-expense-paid sporting, entertainment, and recreational events, and other perk-filled offers to its prospective customers to win business and boost their bottom line through illegal kickback schemes. Today’s agreement by Athena to pay $18.25 million should send a strong message to anyone thinking about engaging in this type of illegal activity.”

Second, Athena ran a “Client Lead Generation” program. Athena paid existing clients for referring potential new clients. Athena paid up to $3,000 for referrals, regardless of how much (if any) time the existing client spent with the lead. This program enabled Athena to sign up hundreds of new healthcare provider clients.

Third, Athena entered into “Conversion Deals” with competing Health Information Technology (“HIT”) companies that were discontinuing their EHR products. Under this program, Athena paid companies to recommend that their clients transition to Athena’s EHR platform. Athena based the amount of payments on the number and value of clients successfully converted to athenaOne or athenaClinicals.

Corrosive Effect of Kickbacks

Federal law provides financial incentives for health care providers to adopt and use EHR technology. Our health care system relies heavily on this technology to accurately record and transmit vital patient information. As DOJ’s press release notes:

“If the benefits of Electronic Health Records are to be fully realized, patients must be confident providers have selected the most effective system – not the one paying the largest kickbacks. Time and again, we’ve seen fraudulent activity undermine the integrity of medical decisions, subvert the health marketplace, and waste taxpayer dollars. We will continue to hold accountable those who provide illegal incentives in order to influence the decision-making of health care providers.”

Phillip M. Coyne, Special Agent in Charge for the Office of Inspector General of the U.S. Department of Health and Human Services

The Government contended that Athena provided kickbacks to increase its sales while causing healthcare providers to submit false claims. As a result, the Medicaid and Medicare programs paid millions of dollars in false claims for incentive payments for adoption and “meaningful use” of Athena’s EHR technology.

Athena is Latest EHR Company to Settle With DOJ

This is the Government’s fourth False Claims Act settlement with an EHR company. In the announcement, the Department of Justice underscored its commitment to pursuing kickback cases involving the EHR industry:

“This resolution demonstrates the department’s continued commitment to holding EHR companies accountable for the payment of unlawful kickbacks in any form. EHR technology plays an important role in the provision of medical care, and it is critical that the selection of an EHR platform be made without the influence of improper financial inducements.”

Brian Boynton, Acting Assistant Attorney General for the DOJ’s Civil Division.

The United States previously settled cases against EHR providers eClinicalWorks ($155 million), Greenway Health LLC ($57.25 million), and Practice Fusion, Inc. ($145 million) for violating the False Claims Act, including through illegal kickback programs.

EHR technology is critical to providing health care to patients. Doctors and patients alike rely on this powerful tool. Electronic health record fraud costs taxpayer dollars and jeopardizes patient safety. If you have information about possible EHR fraud, please contact us.